SUI's Object-Oriented Blockchain: A Web3 Game Changer?

H2: The Promise of Object-Oriented Architecture

Sui is pitching itself as the next big thing in Web3, thanks to its object-oriented architecture. The claim is that this design allows for faster transactions, lower fees, and better developer tools. But does the data back up the hype? Let's break it down.

H2: Parallel Processing and Speed Claims

Sui's core innovation is treating everything on the blockchain as an object. This, they say, enables parallel transaction processing. Instead of processing transactions sequentially, Sui can supposedly handle multiple transactions at once, dramatically increasing throughput. They claim many transactions finalize in under half a second. The analogy here is like moving from a single-lane road to a multi-lane highway; more cars (transactions) can pass through at the same time.

H2: Real-World Impact and Security Concerns

Now, the question is, how significant is this speed boost in the real world? It’s one thing to claim low latency in a controlled environment; it’s another to maintain it under heavy network load. Without actual transaction volume data, it's hard to gauge the true impact. And while bypassing consensus for certain transactions sounds efficient, what are the security trade-offs? (This is the part of the report that I find genuinely puzzling. They emphasize speed but gloss over potential vulnerabilities.)

H2: Regulation as a Catalyst

H2: Increased Regulatory Clarity and Institutional Adoption

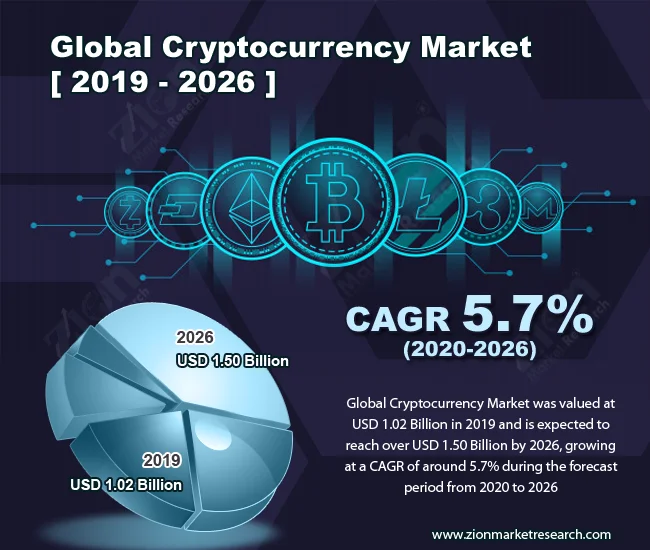

Looking beyond the tech itself, the broader crypto landscape is also evolving. TRM Labs reports that 2025 saw increased regulatory clarity, which fueled institutional adoption. About 80% of the jurisdictions they reviewed saw financial institutions launching digital asset initiatives. The US GENIUS Act for stablecoins and the EU's MiCA rollout are prime examples. For more details, see the Global Crypto Policy Review Outlook 2025/26 Report.

H2: Balancing Regulation and Innovation

But here's the potential discrepancy: While increased regulation is generally seen as a positive, it also introduces compliance costs and limitations. Will these regulations stifle innovation, or will they provide a stable foundation for growth? The answer, as usual, probably lies somewhere in the middle. What’s more interesting, is that this regulatory push seems to be primarily focused on stablecoins. We're seeing institutions dipping their toes in the water with assets that are designed to be stable, not volatile.

H2: Regulation's Impact on Illicit Finance

The report also highlights the impact of regulation on illicit finance. VASPs (Virtual Asset Service Providers) in regulated jurisdictions have significantly lower rates of illicit activity. This suggests that regulation, when properly implemented, can indeed make the crypto ecosystem safer. (Though, it's worth noting that illicit actors will always seek out the path of least resistance, so the problem will never be completely solved.)

H2: The Need for Global Consistency

The Bybit hack, where North Korean actors laundered over $1.5 billion in Ethereum, underscores the need for global consistency in regulation. The attackers exploited unregulated OTC brokers, cross-chain bridges, and decentralized exchanges. This incident highlights the importance of closing regulatory gaps and improving cross-jurisdictional coordination.

H2: Conclusion: The Sui Gamble

H2: The Promise vs. The Reality

Sui's object-oriented design offers a compelling vision for the future of blockchain technology. The promise of faster transactions and lower fees is certainly appealing. However, the real-world impact remains to be seen. We need more data on transaction volumes, network performance under stress, and the security implications of bypassing consensus.

H2: Navigating the Regulatory Landscape

The broader regulatory landscape is also evolving rapidly. Increased clarity and institutional adoption are positive signs, but compliance costs and limitations could also stifle innovation. The key will be finding a balance between fostering innovation and ensuring stability and security. In the meantime, stablecoins seem to be paving the way for more institutional involvement, offering a less volatile entry point into the crypto world.

H2: A Calculated Bet, Not a Revolution

Sui's approach is a calculated bet that could pay off, but it's not a guaranteed revolution. The numbers will ultimately tell the tale.